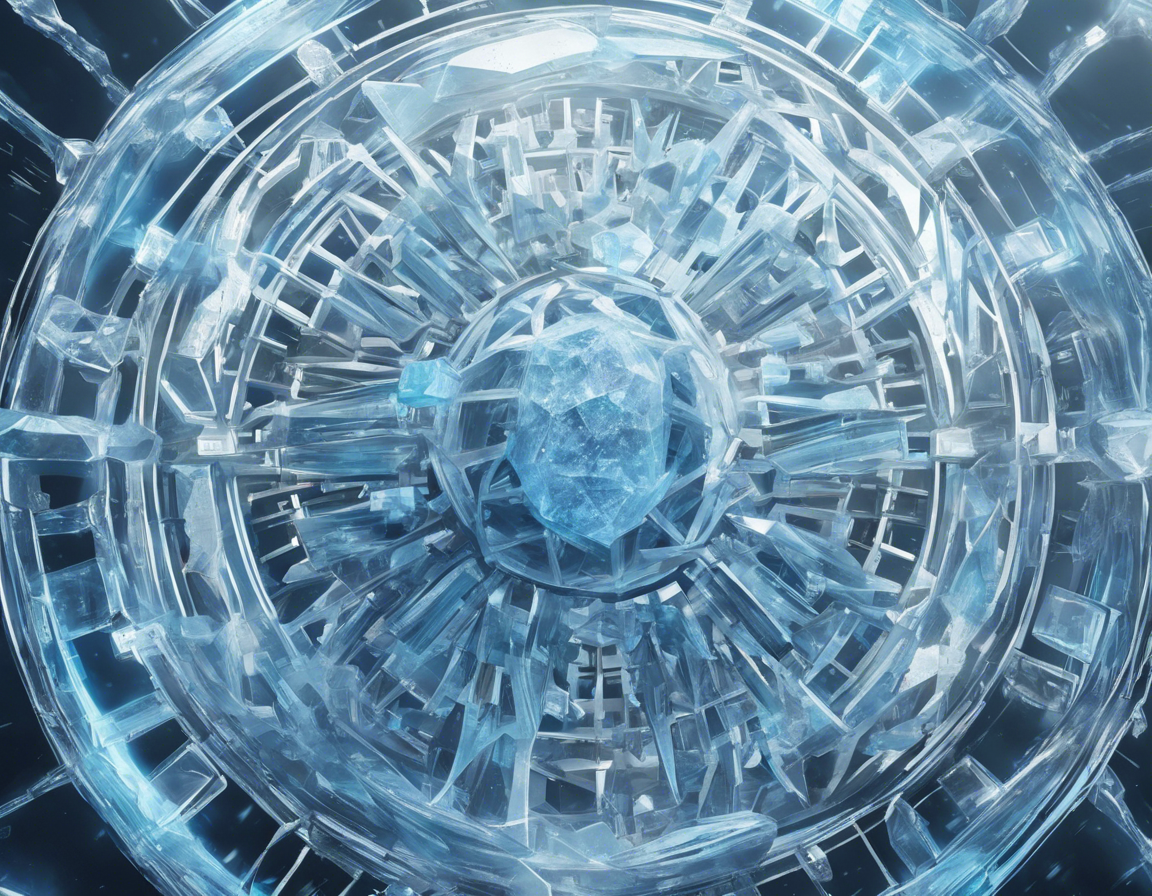

Cryptocurrencies have taken the financial world by storm, revolutionizing the way we think about money and assets. Among the various digital assets, decentralized finance, or DeFi, has emerged as a prominent player in the space. One of the latest innovations within the realm of DeFi is decentralized ice price, which has the potential to disrupt traditional markets and open up new opportunities for investors. In this article, we will explore what decentralized ice price is, how it works, its benefits and challenges, and its future implications.

What is Decentralized Ice Price?

Decentralized ice price refers to a new concept within the decentralized finance ecosystem where the price of ice is determined through a decentralized network of participants, rather than being controlled by a centralized authority or entity. This decentralized approach allows for greater transparency, accessibility, and efficiency in setting the price of ice, which can have various applications and implications in the world of digital assets.

How Does Decentralized Ice Price Work?

Decentralized ice price works through the use of blockchain technology and smart contracts. Participants in the decentralized network, also known as validators or oracles, provide real-time data on various factors that can influence the price of ice, such as supply and demand, weather conditions, production costs, and market trends. This data is then processed and verified by the network using consensus mechanisms, such as Proof of Stake or Proof of Work, to determine the most accurate and up-to-date price of ice.

Benefits of Decentralized Ice Price

Transparency and Security

Decentralized ice price provides greater transparency and security by eliminating the need for intermediaries or third parties to set the price of ice. This reduces the risk of manipulation, fraud, or human error, ensuring a more reliable and trustworthy pricing mechanism.

Accessibility and Inclusivity

Decentralized ice price opens up new opportunities for investors, both large and small, to participate in the ice market. By removing barriers to entry and enabling anyone to contribute to the price-setting process, decentralized ice price promotes a more inclusive and dynamic market ecosystem.

Efficiency and Innovation

Decentralized ice price drives greater efficiency and innovation in the ice industry by streamlining processes, reducing costs, and fostering competition. With real-time data and automated price-setting mechanisms, decentralized ice price enables faster and more accurate decision-making for market participants.

Challenges of Decentralized Ice Price

Volatility and Risk

Decentralized ice price may be more susceptible to volatility and risk, as it relies on a decentralized network of validators whose actions and incentives may impact the price of ice. Market fluctuations, technical glitches, or malicious attacks could potentially disrupt the price-setting process and lead to unintended consequences.

Regulation and Compliance

Decentralized ice price may pose challenges in terms of regulation and compliance, as it operates outside of traditional frameworks and jurisdictions. Regulators and policymakers may struggle to oversee and monitor decentralized ice price effectively, raising concerns about market integrity and investor protection.

Future Implications of Decentralized Ice Price

Decentralized ice price holds significant promise for the future of digital assets and decentralized finance. As the technology matures and adoption increases, decentralized ice price could pave the way for a more efficient, transparent, and inclusive financial system. With its potential to disrupt traditional markets and redefine price discovery mechanisms, decentralized ice price is poised to revolutionize the way we perceive and interact with digital assets.

Frequently Asked Questions (FAQs)

-

What is the role of validators in decentralized ice price?

Validators in decentralized ice price are participants in the network responsible for providing real-time data on factors that influence the price of ice and verifying the accuracy of this information through consensus mechanisms. -

How is the price of ice determined in a decentralized network?

The price of ice in a decentralized network is determined through a process of data collection, verification, and consensus by validators or oracles, who contribute information on supply and demand, market trends, production costs, and other relevant factors. -

What are the advantages of decentralized ice price over a centralized pricing mechanism?

Decentralized ice price offers greater transparency, security, accessibility, and efficiency compared to a centralized pricing mechanism, as it eliminates the need for intermediaries, reduces the risk of manipulation, and promotes inclusivity and innovation in the ice market. -

What are the potential risks of decentralized ice price?

Decentralized ice price may be susceptible to volatility, risk, regulation, and compliance challenges, as it operates in a decentralized and unregulated environment where market fluctuations, technical issues, and regulatory uncertainties could impact the price-setting process. -

How can investors benefit from decentralized ice price?

Investors can benefit from decentralized ice price by gaining access to a more transparent and efficient pricing mechanism, diversifying their investment portfolio, and participating in a decentralized financial ecosystem that offers new opportunities for growth and innovation.